Avalara — AvaTax

Sep. 05, 2014

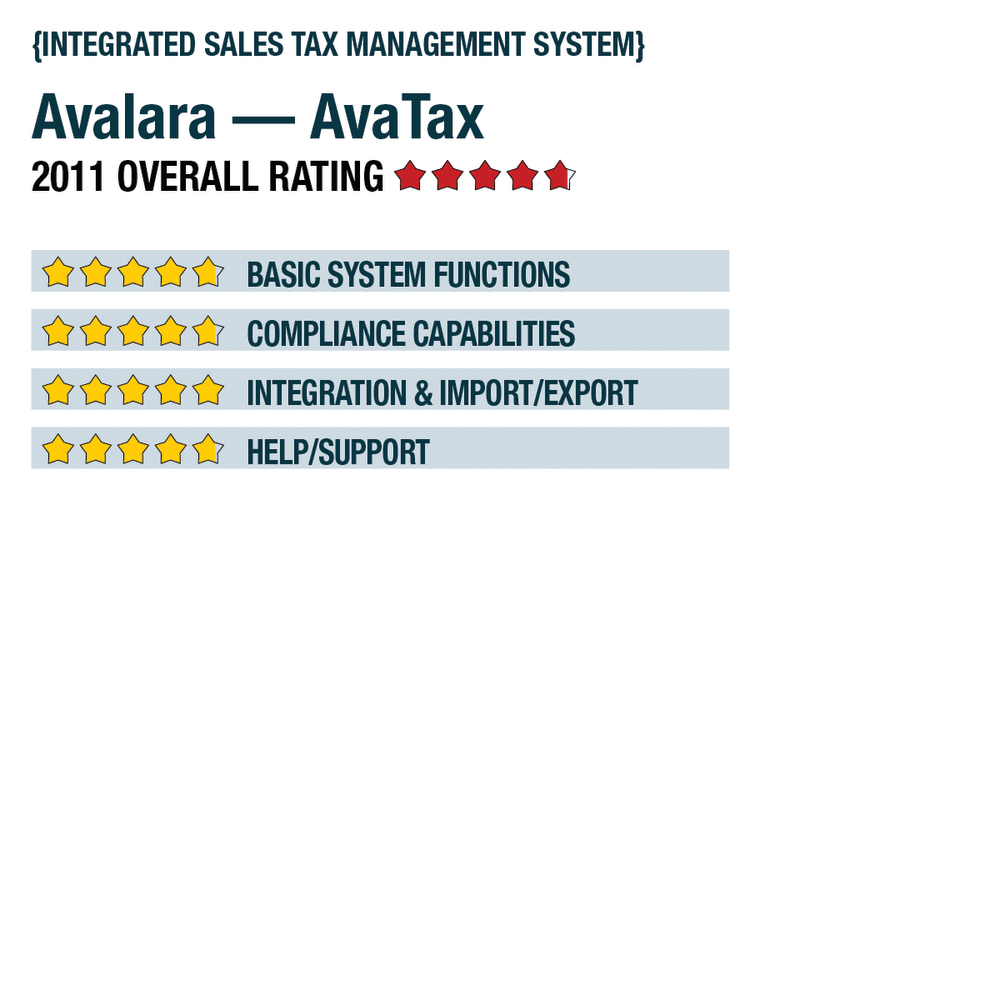

2011 Overall Rating 4.75

Best Fit

Businesses with sales across dozens, hundreds or even more taxing jurisdictions across the United States and Canada, with the need to automate tax rate lookup into their sales and ecommerce systems.

Strengths

- Seamless integration into accounting system

- Rates are maintained by Avalara, no updates required

- Generous reporting & oversight

- Rates & rules for 14,000+ jurisdictions

- Streamlined Sales Tax Compliance

Potential Limitations

- No direct self e-file or e-pay for business

- Primarily for client-side use, but with some multi-client functions

Executive Summary & Pricing

For businesses with sales across dozens or even hundreds or more unpredictable jurisdictions, integration of AvaTax into an accounting system takes almost all of the routine and often tedious work out of sales tax management. The rates are maintained and updated by Avalara, and then automatically feed into the accounting system during a transaction, with liability reports and forms preparation generated by the program. The addition of the managed returns service can take even more of the headache out of compliance. Pricing for AvaTax depends on the accounting/ERP program into which it will be integrated, and the number of transactions that will be processed (rate lookups). For the QuickBooks version, pricing starts at $350 per year for low-volume entities (up to 700 transactions). For higher volume businesses with up to 7,000 transactions annually, the cost is about $0.35 per transaction.

Product Delivery Methods

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions – 4.75

Compliance Capabilities – 4.75

Integration/Import/Export – 5

Help/Support – 4.75